Disclosure: I am long FB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Those who have seen some of my posts know that I was very happy to see Facebook finally turn public. Not only did I think it would provide some terrific trading opportunities but it also gives me a few more ways to play internet stocks. Today, I wanted to dig a bit deeper into a few of them to determine which of these stocks I'd rather own with a 1-2 year horizon. Social web is a vague term that can mean any number of different things. I decided to limit myself to public companies that use the social web as a primary source of business.

That means excluding some private companies such as Twitter (hopefully not for long) but also Google (GOOG) (which runs Google+, a relevant network depending on who you ask). I also excluded stocks such as Netflix (NFLX), which are working on increasing their social reach. I was left with these 5 names:

Facebook (FB)

LinkedIn (LNKD)

TripAdvisor (TRIP)

Zynga (ZNGA)

Yelp (YELP)

As you may know, four of these own their network (FB, LNKD, YELP, TRIP), while Zynga has deep integration with Facebook, especially. You could also say that TripAdvisor depends on Facebook, but I would argue it's not nearly as important. Owning your network is critical in the long term as the networks can (and do) turn on their "apps" fairly frequently. Just ask any of the services, such as StockTwits, which got cut off by Twitter. Let's start off by looking at the different numbers for these 5 stocks:

| Ticker | Name | Price | EPS | PE Ratio | PE Next Year | 2012 Return |

| LNKD | LinkedIn Corp. | 113.15 | 0.15 | 749.67 | 87.85 | 82.23 |

| YELP | Yelp Inc. | 21.52 | -1.1 | N/A | 169.33 | 6.9 |

| FB | Facebook Inc. | 28.76 | 0.52 | 60.37 | 42.33 | 4.32 |

| ZNGA | Zynga Inc. | 2.63 | -1.4 | N/A | 200.83 | 2.12 |

| TRIP | TripAdvisor Inc. | 44.12 | 1.33 | 33.52 | 23.98 | 4.75 |

It's certainly a challenge to value these businesses right now. My standard tool is the P/E ratio which is very difficult to use. Take Facebook which trades at a P/E of 60 or so. I've heard so many different arguments such as the fact that there was no way that Facebook could come up with growth to justify such a ratio. Why?

-"Facebook already has a billion users.. how many more can it get?"

-"It's not like it can keep putting more and more ads"

-"etc"

When I made the bull case for Facebook and eventually did buy it, I never assumed that growth would come from user growth or banner ads. I made the case that Facebook would become so much more, could build an advertising network. See tremendous growth in credits, offer merchants the ability to sell products and services through its pages, etc. Some of those might never happen, others already have started (gifts), and some that I had not considered (VOIP) are being tested. The fact is that growth was never going to come from those same revenue sources. That also means its very difficult to value a business such as Facebook (or others) based on their current numbers. Still, let's take a look at current revenue and income trends for these 5:

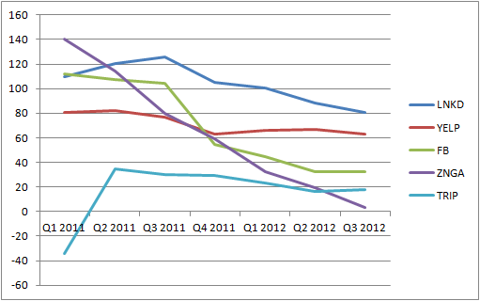

Quarterly Sales Growth

(click to enlarge)

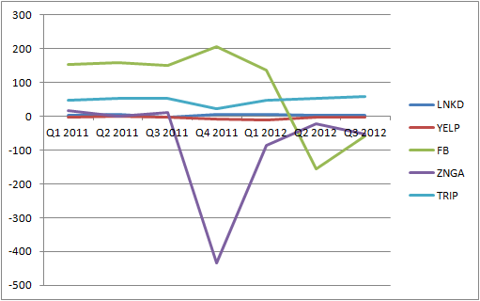

Quarterly Net Income

(click to enlarge)

A Few Thoughts On These Names

Facebook : I remain a big believer in Facebook, in Zuckerberg, etc. I bought at $19.999 and do expect to keep that position in the long term. I think the key is revenue diversification. Gifts is a great step towards that. I also think it's interesting that so many are surprised that Facebook can make money out of its mobile app. That was a given. Having people log in more and spend more time is obviously great news, even if it's on a mobile, smaller screen. Facebook's future is not based on banner ads or even newsfeed ads. Companies such as Nike and Coca-Cola spending millions of dollars to promote their Facebook pages tells me a lot about where they think this is going.

Growth Potential: Significant

Risks Involved: Moderate

LinkedIn: Terrific company, I think the world of LinkedIn's underlying business. It has a sound business plan, a highly valuable client base (professionals), a lot of user data, and I would say that it has a lot of different possibilities in terms of revenues. An obvious one is to knock out competitors such as Monster Worldwide (MWW) and Dice Holdings (DHX) in classifieds but I also think that consulting, providing paid research and competing with consultancy firms is within its reach.

Growth Potential: Significant

Risks Involved: Fairly low

TripAdvisor: The company faces a lot of competition and is much more limited in terms of future possibilities but I do think it's very well positioned as a brand leader in the travel space. Ideally, it would be able to start offering a back system to smaller businesses around the world, etc.

Growth Potential: Moderate

Risks Involved: Moderate

Zynga: The stock that was perhaps my worst call last year is looking very damaged at this point. They're into cost-cutting strategies, closing offices and games. The company is expected to lose money in the next 2 quarters at which point it could resume making profits.

Growth Potential: Moderate

Risks Involved: Very high

Yelp: For me, Yelp is a much more difficult one to value. It's a very useful products, has great integration with merchants but also has a lot of unsatisfied merchants, faces a ton of competition from Google and others in the local space. It also has upside as there have been a lot of rumors over the past few years about possible acquisitions, etc.

In The End

I have to consider the upside and downside risks in order to get to an order but here it goes:

1-Facebook

2-LinkedIn

3-TripAdvisor

4-Yelp

5-Zynga

Source: http://seekingalpha.com/article/1096151-which-social-web-stocks-to-own-going-into-2013?source=feed

prince johan friso windows 8 logo anguilla gone with the wind michael jordan checkers imbibe

No comments:

Post a Comment